Our Services

Option pricing

- Binomial trees

- Trinomial tree

- Finite differences

Implied volatility model

Monte Carlo Simulation

Implementing backtesting

- Financial API

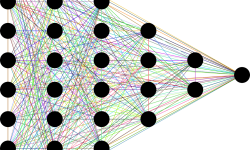

Supervised Learning

- Regression on simulation

Unsupervised Learning

- K-mean clustering

Reinforcement Learning

Dynamic Hedging

- Backtest validation

Big data & Hadoop in trading

- HDFS

- YARN

- MapReduce

- MongoDB

Derivatives

Calibration and Simulation

In derivatives analytics, theoretical valuation and market-based valuation works in opposite ways. Theoretical valuation (Black-Scholes models as the benchmark and many generations of evolvement) takes this approach: develop a model, parametrize it and then derive values for options. In contrast,

market-based valuation uses option prices as inputs and parametrize a market model that yields the market price as the model calibration. Monte Carlo simulations serves as an efficient vehicle to solve derivatives pricing models numerically. After the option calibration, investors then can explore for opportunites in trading, hedging or risk management.

Dynamic hedging serves as a great method to hedge against price changes of options. In reality, option price paths are often discontinuous and volatility is always changing. Artificial intelligence enables considerations of all those factors into the dynamic option market and identifies true valuable hedge opportunities that are otherwise undetectable.

Our Strength

With in-depth theoretical foundations and machine learning implementations, DATAMIMO calibrates our option models in many different ways to consider jump component and implied volatilities. We employ cloud computing to ensure the security and speed of our models. The complexity of those models and big-dimensional matrix calculations also make it hard to reproduce our unique approach.

DATAMIMO identifies hard-to-capture hedging opportunities in the options market while managing the risks in a unique way: understanding that “black swans” in the derivatives market is not a rare event as many investors thought, the risk management system we build is not based on a Gaussian distribution assumption but through numeric integration of ensembles of noise distribution assumptions.